By Consumer Metrics Institute

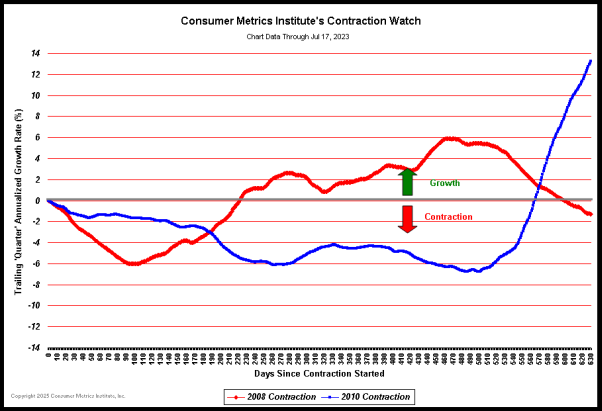

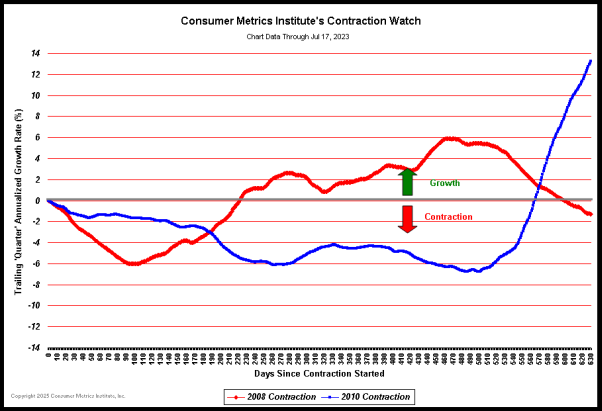

On October 20, 2010 the aggregate severity of the 2010 contraction in consumer demand surpassed the similar measure of economic pain experienced during the “Great Recession.” And a glance at our “Contraction Watch” tells us that the pain is not about to end anytime soon:

(Click on chart for fuller resolution)

In the above chart, the day-by-day courses of the 2008 and 2010 contractions are plotted in a superimposed manner, with the plots aligned on the left margin at the first day during each event that our Daily Growth Index went negative. The plots then progress day-by-day to the right, tracing out the changes in the daily rate of contraction in consumer demand for the two events.

The true severity of any contraction event is the area between the “zero” axis in the above chart and the line being traced out by the daily contraction values. By that measure the “Great Recession of 2008″ had a total of 793 percentage-days of contraction over the course of 221 days, whereas the current 2010 contraction has reached 820 percentage-days over the course of 282 days — without yet clearly forming a bottom. The damage to the economy is already 3% worse than in 2008, and the 2010 contraction has lasted 28% longer than the entire 2008 event without yet starting to recover.

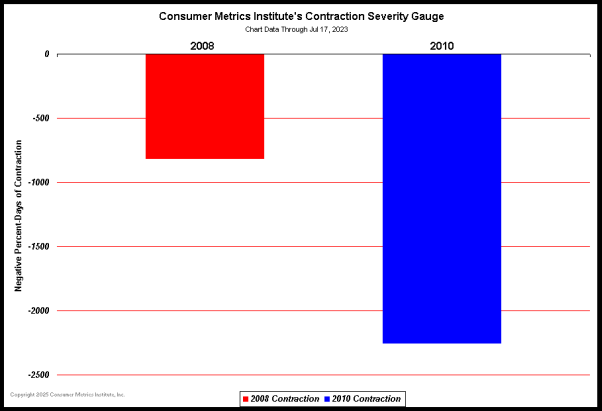

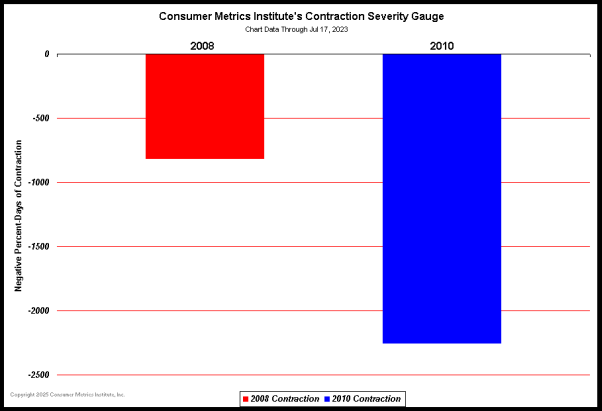

We have constructed a new chart to assist in the visualization of the “percentage-days” severity of the two contraction events:

(Click on chart for fuller resolution)

In the above chart the red vertical bar represents the -793 percentage-days of contraction in consumer demand that we measured in 2008. The blue vertical bar represents the same measure (to date) for the 2010 event. But since the 2010 event is not yet over, we have projected the eventual full extent of the 2010 event with the purple vertical bar. That projection is an average of several recovery scenarios, all of which conservatively assume that the bottom has already been reached.

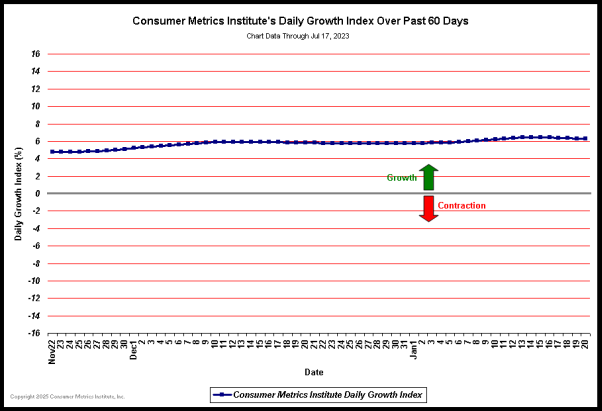

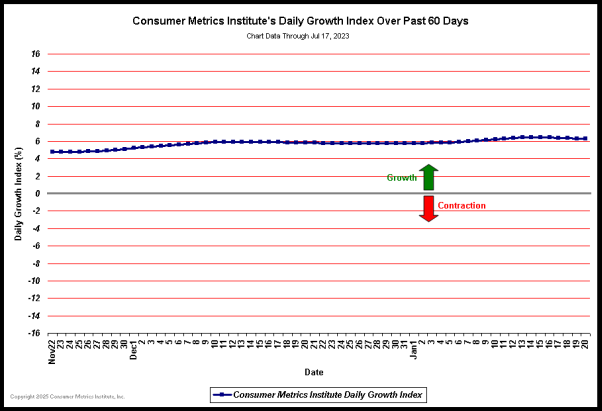

Meanwhile, we are left to wonder if a bottom as been forming in the current contraction. A detailed view of our Daily Growth Index over the past 60 days could be viewed as either encouraging or simply “more of the same,” depending on your state of mind:

(Click on chart for fuller resolution)

It is important to remember that our Daily Growth Index is a moving 91-day “trailing quarter” average for our Weighted Composite Index (converted from a nominal base-100 index into a year-over-year percentage change). As such it responds to the values of both the newest day’s Weighted Composite Index (just entering the 91-day average for the first time) and the 92nd day back — which has just fallen out of the average. The current values of the Weighted Composite Index are in the -5% to -7% range, whereas the oldest days falling out of the average reflect a weaker period in late July when the Weighted Composite Index was in the -6% to -9% range. Even if current consumer demand remains relatively constant we should expect the trailing 91-day “trailing quarter” to improve slightly from recent record lows over the next 30 days. But we are unlikely to see significant improvements until the current values of the Weighted Composite Index move substantially above the zone between 94 and 96 — which we consider unlikely until after the mid-term elections (see our comments on the impact of Political “FUD” for why we consider that unlikely).

From time to time we have been asked whether we consider the current contraction in consumer demand to be the second “dip” in a “double dip” recession. From a qualitative perspective, we believe that the “Great Recession” is not so much a “double-dip” as a single “big-scoop” that changed character somewhere in the middle. We understand that the NBER says that the recession ended in June 2009. However quantitatively/technically correct that may be by NBER standards, by “Main Street” gut-feeling standards the NBER assertion is somewhere between questionable and ludicrous, depending on the personal circumstances of the observer.

Our data indicates that the consumer portion of the “Great Recession” unfolded (and is still unfolding) along these lines:

? The recession most likely started with a drop in consumer confidence, triggered by bad financial news (Bear Stearns, Lehman Brothers, etc.) and media coverage of the “Housing Crisis”/sub-prime loans.

? The initial recessionary downturn was accelerated by political uncertainties in 2008 and rising energy prices.

? An organic recovery started late in 2008 when energy prices collapsed, lasting well into 2009 with help from short term stimuli (“Cash for Clunkers” and the Federal New Home Tax Credit).

? During 2009 (and now deeply into 2010) a ruthless corporate obsession with short term earnings exacerbated the already weak employment picture, even as equity markets recovered.

? By late summer 2009 consumers realized that this was not a “garden variety” recession, as unemployment persisted and fixed incomes plummeted.

? By early 2010 demographically appropriate “frugal” consumer habits had emerged, reducing discretionary spending in favor of increased personal savings (or the paying down of debt).

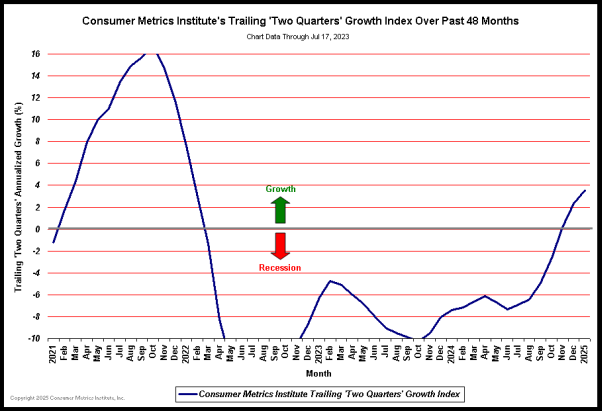

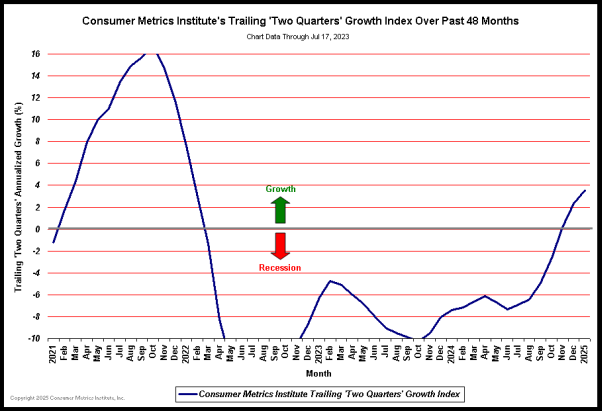

The two reversals described above can be clearly seen in a chart of our trailing 183-day “two consecutive quarters” index — which is designed to closely follow the “two consecutive quarters” definition of a recession — for the past 48 months:

(Click on chart for fuller resolution)

Credit the growth spurt in the middle of the above chart to a combination of dropping energy prices, consumer shopping reverting to form after a brief hiatus, positive psyches as a result of a honeymoon with the new administration, and the consumer oriented parts of the stimulus packages. All that changed when consumers realized (in late 2009) that things were not actually getting any better.

But missing from the above narrative is the potential permanence of the damage inflicted on certain consumers. Those consumers living through foreclosures will have suffered lifestyle and financial reversals that may require a decade or longer to rehabilitate. And even those fortunate enough to stay current with their mortgages may have had their dreams of upward mobility (or mobility of any sort) crushed. In both of these cases the damage will have caused changes in habits (the “new frugality”) that could last decades, if not the rest of their lives. The “Great Depression” of the 1930′s changed an entire generation’s attitudes about banks and spending permanently. While this economic strife may not be as severe, the emotional scars may persist longer than policy makers might wish.

Also absent from the above narrative is the impact of the Federal Reserve’s extended “zero rate” policy on those attempting to live on a lifetime’s modest accumulation of wealth. On Wall Street and inside the Beltway there are no perceived victims of low interest rates, because low rates result in obscene spreads between the real cost of institutional borrowing (essentially zero) and the real rate of consumer lending (18% to 24% on real-world short term loans). Meanwhile every barrier possible has been raised to prevent those lower rates from propagating to those most in need of longer term relief.

Lost on the policy makers is the fact that what’s good for banks is not necessarily good for their depositors. Simply stated, it has become impossible to live on the earnings generated by a lifetime of middle class savings. In June 2007 an accumulation of $2,000,000 in an IRA or 401K would translate into $100,000 in annual income when invested in 1 year T-Bills, an annual income higher than the per capita income in any of the richest nations on earth. That was certainly a reasonable target for a middle class household, and one that would allow a comfortable retirement without significant changes in lifestyle.

Today the same $2,000,000 (if it was somehow preserved throughout the “Great Recession”) would earn $4,200 per annum if invested similarly — or roughly the per capita income in the Republic of the Congo. No wonder that many “Baby Boomers” are increasing savings and postponing retirement to the chagrin of younger people desperately looking for jobs; the alternative is a third-world lifestyle.

——————————————————————————————————————————————————

The content on this site is provided as general information only and should not be taken as investment advice. All site content shall not be construed as a recommendation to buy or sell any security or financial product, or to participate in any particular trading or investment strategy. The ideas expressed on this site are solely the opinions of the author(s) and do not necessarily represent the opinions of firms affiliated with the author(s). The opinions of all guest authors or contributors can and will differ from those of Mr. Roche. These opinions do not necessarily represent the opinions or investment decisions of Mr. Roche. The author(s) may or may not have a position in any security referenced herein and may or may not seek to do business with one another or companies mentioned via this website. Any action that you take as a result of information or analysis on this site is ultimately your responsibility. Consult your investment adviser before making any investment decisions.

A brief note on comments – The increase in users in recent months has resulted in an increase in unproductive comments. Any user who engages in the use of racial epithets or uses the comment section as a place to insult other users will be banned from the site. The comment section is welcome to all readers who are interested in asking pertinent questions and/or engaging in thoughtful, intelligent, and productive debate. In short, just be nice. Thanks.

Post Footer automatically generated by Add Post Footer Plugin for wordpress.